Investment Tracks

Multi Family

A group investment in an apartment facility

Investment Fund

Consolidating investor groups to invest in real estate assets

Development

The investor is a partner in a new real estate project

Loan

The investor lends money to the Partnership for property acquisition

RM Group Investment Principles

At RM Group, we act upon clear investment principles and a proven model for analyzing and maximizing investments. The model was developed by Ran Harel and Matan Pertman, based on their personal experience in real estate investments in Israel and abroad. Real estate, unlike many other investment venues, continuously generates passive income, regardless of the property’s value. Our main goal is to target properties that will generate a regular passive income for our customers.

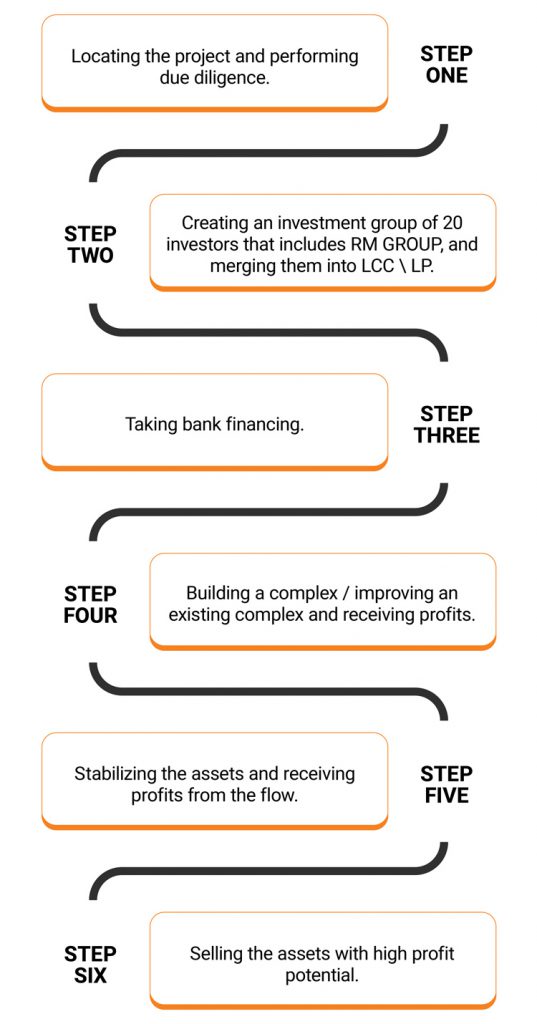

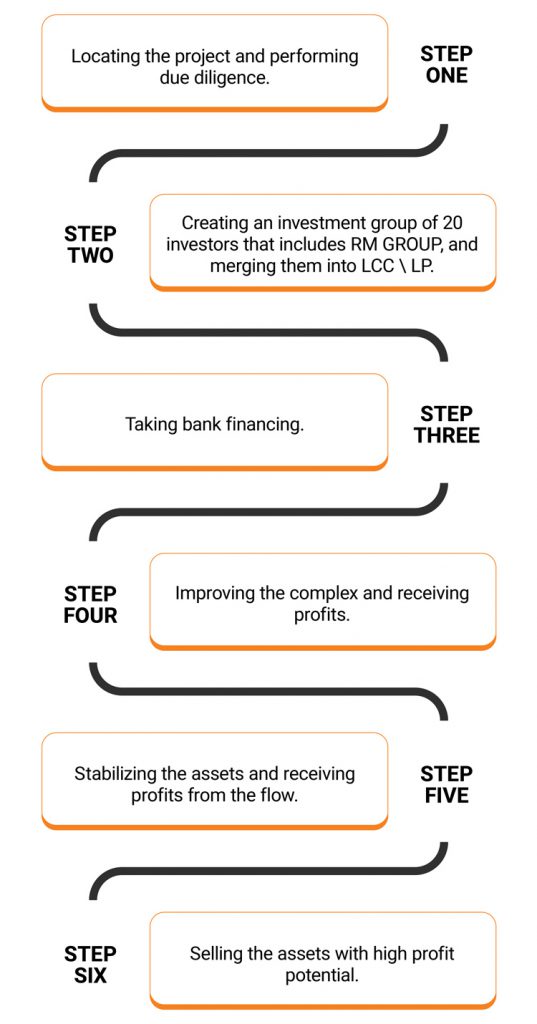

MULTI-FAMILY

What is an investment in the multi family track? A group investment track in a yielding apartment complex. The apartment complex is built and rented, including multiple infrastructures and facilities to ensure tenant welfare. This is a popular residential standard in the U.S., which continues to gain momentum. Therefore, an investment like this is considered stable and good and thus more and more major insurance companies have been investing in such complexes using their insured’s funds. The potential profit for this track is very high, seeing that beyond the ongoing rental income, there is also potential for selling the property after 3-5 years of improvement.

Advantages:

- Continuous rental income derived of an existing and mostly occupied property.

- Higher investment distribution over multiple units in the complex.

- Relatively low taxation.

- Capital gain potential upon sale at the end of a 3-5 year investment period.

- Convenient financing terms compared to other investment channels.

- Identical interests – We invest our money in every investment using this track and the profit distribution mechanism is based on project success.

Useful Information

- Investors enjoy a pro rata share of the property based on the invested amount and do not exclusively own the property.

- Investors cannot introduce changes to the property and all such decisions are made by the managing body.

Investment fund

What is an investment fund investment track? Another group investment option where we bring several investors together and create an investment portfolio based on real estate assets in the U.S. In so doing, we create an investment that offers maximum distribution and stability. By implementing this track, we actually utilize the group’s power in order to purchase a large number of attractive properties. We invest together with you and manage the investment – from locating the properties to dividing the profits after deducting all of the expenses.

Advantages:

- Maximum investment distribution among various investment channels, different locations and assorted liquidity levels.

- Manager flexibility for liquidating funds throughout the investment lifetime.

- Identical interests – We invest our money in every investment. In addition, the profit distribution mechanism is based on project success.

Useful Information:

- Investors enjoy a pro rata share of the property based on the invested amount and do not exclusively own the property.

- Investors cannot introduce changes to the property and all such decisions are made by the managing body.

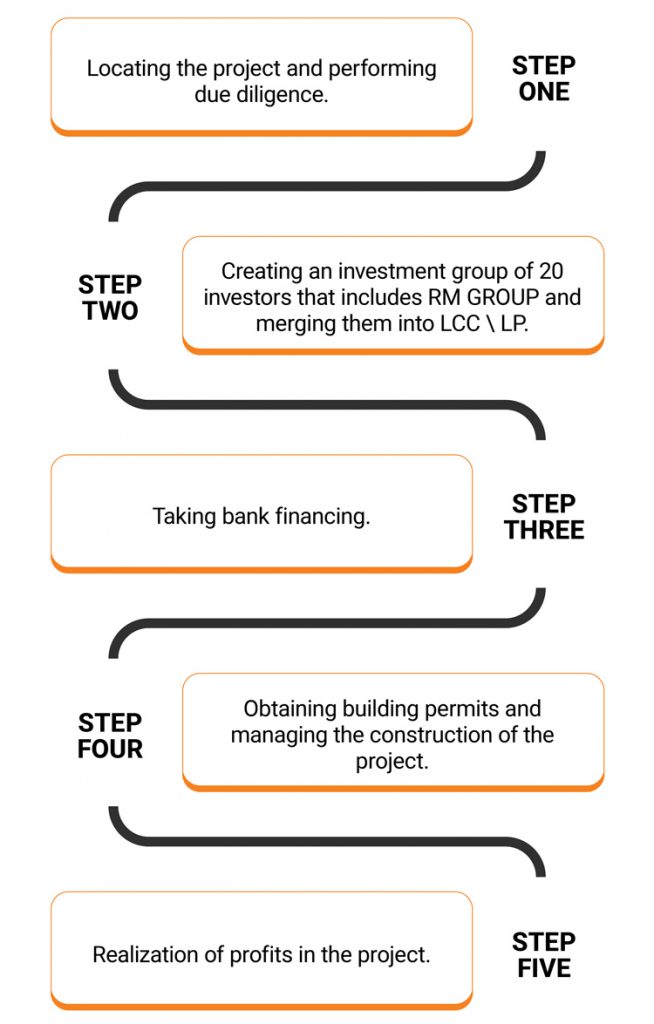

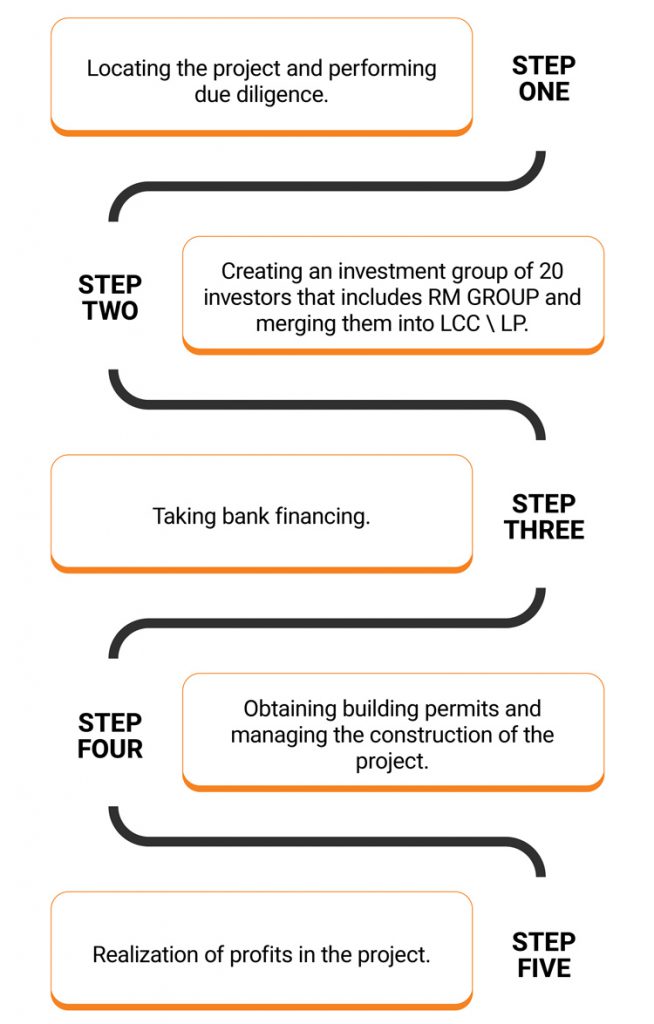

DEVELOPMENT

In this investment channel, the investor is in fact our partner in the entrepreneurship of a completely new real estate project abroad. This means that we start everything from the most initial stage, locating the land, obtaining building permits, planning the construction and infrastructure until the successful completion of the project and its realization in profit. Only after the sale of the property itself, will the investor receive the amount of his investment plus the profits from the sale transaction itself.

In this investment channel, the investor is in fact our partner in the entrepreneurship of a completely new real estate project abroad. This means that we start everything from the most initial stage, locating the land, obtaining building permits, planning the construction and infrastructure until the successful completion of the project and its realization in profit. Only after the sale of the property itself, will the investor receive the amount of his investment plus the profits from the sale transaction itself.

Advantages of the channel:

- Short-term investment up to 3 years.

- Expect high capital gains.

- Direct partnership with the developer and not through a real estate company.

important information

- There is no current flow from the investment and investors enjoy the profit only at the end of construction.

- Do not purchase an existing property and therefore there is usually a higher risk than a profitable investment alongside the expected capital gain.

Loan

What is an investment in a yielding loan track? Investors actually lend the investment partnership money to execute the acquisition of the property. Afterwards, they benefit from a fixed interest on their loan.

Advantages:

- Profit distribution preferences over the developer and entrepreneurial track investors.

- Fixed and preset interest rates.

- Useful Information

- The interest rate is fixed and no capital gain is derived of project sale.

Entrepreneurship

What is an investment in the entrepreneurial track? In this track, investors are actually our partners in developing a new real estate project abroad. In other words, we begin operating together from the earliest stages – locating the land, obtaining construction permits, planning construction and infrastructures, successfully completing the projects and realizing it at a profit. The investors will only receive their investment upon selling the property, along with the profits yielded of the sale transaction.

Advantages:

- Short-term investment up to 3 years.

- High capital gain forecast.

- Direct partnership with the developer, with no brokerage company.

Useful Information

- There is no ongoing flow from the investment and investors only enjoy the profit after construction is completed.

- We do not purchase an existing property and, as such, this investment embodies a higher risk than a yielding investment, alongside the capital gain forecast.